BIX ARTICLE

China smashes bond sale records with over US$234b of bids

Nov 20, 2025

|

4 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

(Nov 19): Just a couple years ago, China was ‘uninvestable’ to some global money managers as its economy reeled from strict Covid curbs and a crackdown on private enterprise.

Now, central banks, sovereign wealth funds and insurers around the world are bidding for the nation’s international debt like never before. The mood change was evident by how easy it was for China to raise a combined US$8.6 billion (RM35.6 billion) by tapping both the dollar and euro bond markets in the last two weeks.

Bids for the two bonds reached a record total of at least US$234 billion. Investors’ robust appetite allowed China to borrow dollars at essentially the same cost as the US, followed by unprecedented demand for its offering in the single currency.

The new-found enthusiasm for Chinese assets has gained traction since April, when the nation’s stocks embarked on a surprise rally due to thawing trade tensions and pro-growth policies such as pursuing technological self-reliance. China’s global debt offerings are also drawing interest at a time of mounting concerns over fiscal woes plaguing developed nations from the US to France.

“We’re seeing a clear shift of capital from traditional developed markets into emerging markets as government debt ratios in the US, France, Japan and the UK continue to climb,” said Samuel Tse, a senior economist at DBS Bank. “Asia is benefitting from this trend, and China is at the top of investors’ lists.”

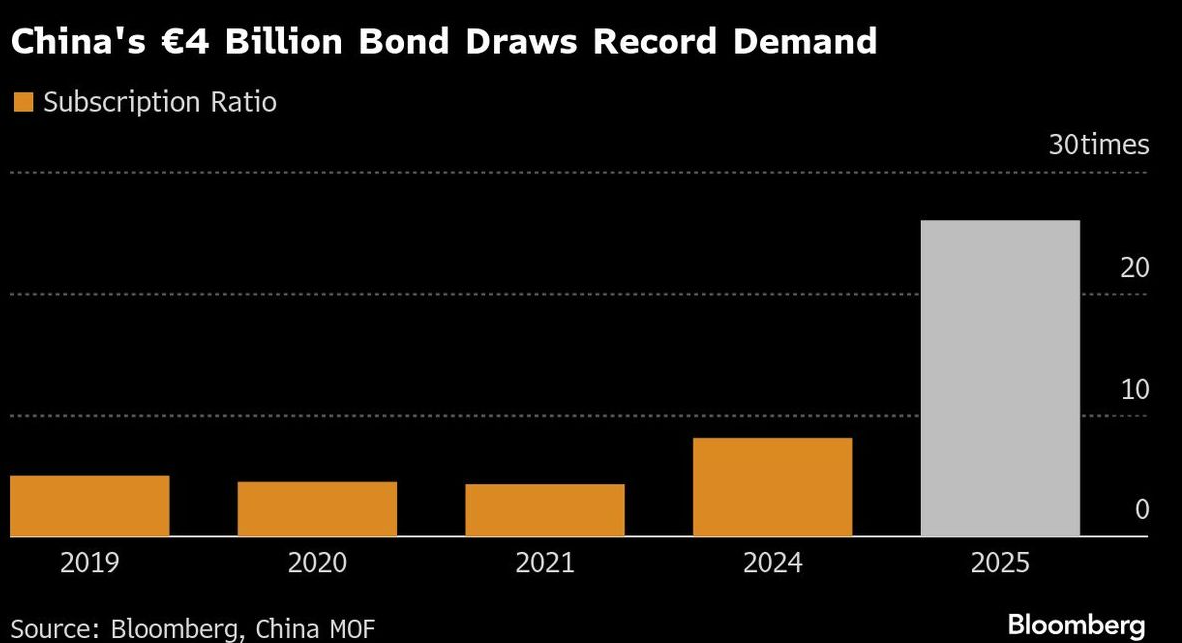

China’s Ministry of Finance sold €4 billion of euro-denominated bonds Tuesday, drawing orders of 25 times the issuance size, the most ever for such offerings by the country. It followed a successful US$4 billion dollar bond sale on Nov 5, which fetched demand of almost 30 times.

The healthy demand enabled China to price the shorter-maturity notes of the dollar offering in line with Treasuries, despite the US having a stronger credit rating and a much bigger role in the global financial system.

As for its euro notes, the four-year tranche priced at five basis points above the mid-swap rate, while the seven-year part ended at 13 basis points above. The risk premiums were both slightly lower than those on China’s existing euro bonds and about 20 basis points more than comparable German sovereign paper at the time of pricing.

China’s assets remain underweighted relative to its importance in the global economy, said Lynn Song, chief Greater China economist at ING Bank. “A truly international investment portfolio aiming to have a proper global representation should always have some exposure to Chinese assets.”

European investors bought 51% of China’s latest euro debt, with 35% snapped up by those in Asia, according to a statement from the country’s finance ministry.

The success of China’s recent dollar bond sale has fueled strong momentum for the euro issuance, said Keith Cheung, head of debt syndicate, Greater China and North Asia at Standard Chartered Plc, one of the arrangers in both bond offerings. “Global investors are actively seeking diversification, yet high-quality Asian sovereign bonds denominated in euros remain scarce.”

China’s strong debt sales added to the appeal of the nation’s assets, which have shown impressive resilience in recent weeks amid a global tech stock sell-off and volatility in developed-nation debt.

“Since the policy shift in 3Q2024, China’s economy has shown increasing signs of stabilisation and demonstrated strong resilience amidst ongoing tariff disputes with the US this year,” said Cary Yeung, head of Greater China fixed income at Pictet Asset Management. “As a result, foreign investors have adopted a more positive outlook on Chinese assets compared to the previous year.”

Article by Bloomberg

Uploaded by Magessan Varatharaja

Disclaimer

The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile. The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Mar 02, 2026

|

6 min read

ARTICLE

Feb 27, 2026

|

6 min read

ARTICLE

Feb 25, 2026

|

3 min read

ARTICLE

Feb 24, 2026

|

7 min read