BIX ARTICLE

Relationship Between Bonds and Interest Rates

Nov 29, 2023

|

7 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

Introduction

In the Fixed Income Market, the relationship between bonds and interest rates is a topic of paramount importance. Investors, policymakers, and financial analysts closely monitor this dynamic interplay, as it has a significant impact on the Malaysian economy and the broader global financial landscape. In this article, we will delve into the unique characteristics of the relationship between bonds and interest rates in Malaysia, shedding light on the factors that influence this intricate connection.

Understanding Bonds

Before we dive into the relationship between bonds and interest rates, it's essential to understand the basics. Bonds are essentially debt securities issued by entities such as governments or corporations to raise capital. When you purchase a bond, you are lending money to the issuer in exchange for periodic interest payments, known as coupon payments, and the return of the principal amount when the bond matures.

The Bond-Interest Rate Relationship

The relationship between bonds and interest rates is fundamental in finance and has a significant impact on the bond market. This relationship can be summarized as follows:

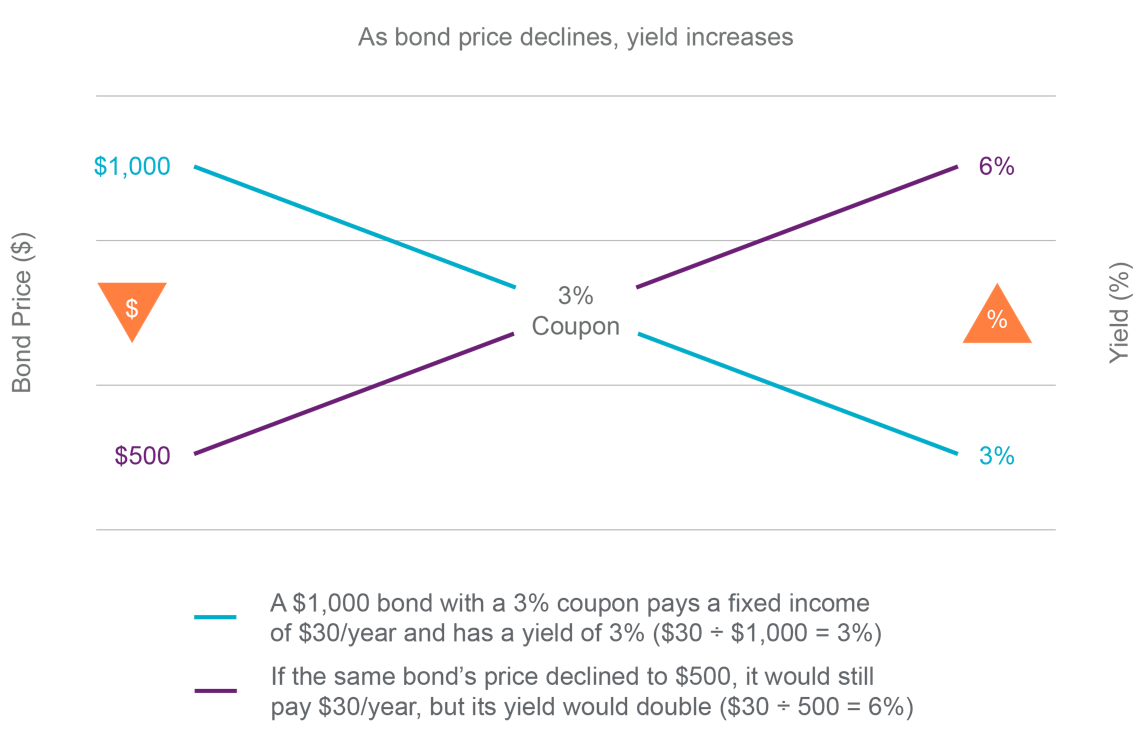

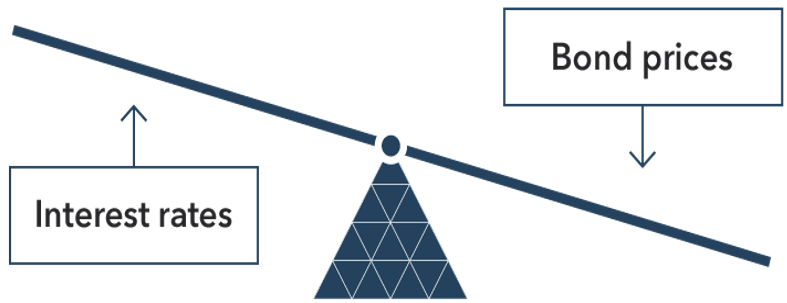

- Inverse Relationship: Bond prices and interest rates (yields) generally have an inverse relationship. When interest rates rise, bond prices tend to fall, and when interest rates fall, bond prices tend to rise.

- When Interest Rates Rise: If interest rates in the market increase, newly issued bonds will typically offer higher yields to be competitive with the new rates. Existing bonds with lower fixed coupon rates become less attractive in comparison, leading to a decrease in their market value. This is because investors can obtain higher yields elsewhere.

- When Interest Rates Fall: Conversely, when interest rates decrease, existing bonds with higher coupon rates become more attractive to investors because they offer a higher return compared to new bonds issued with lower yields. As a result, the prices of existing bonds tend to rise.

- Coupon Rate vs. Yield: The coupon rate of a bond is the fixed interest payment it makes annually as a percentage of its face value. If a bond's coupon rate is equal to the prevailing market interest rate (yield), the bond will typically trade at or near its face value. If the coupon rate is higher than the market yield, the bond will trade at a premium (above face value), and if the coupon rate is lower than the market yield, the bond will trade at a discount (below face value).

- Duration: The sensitivity of a bond's price to changes in interest rates is influenced by its duration. Longer-duration bonds are more sensitive to interest rate changes than shorter-duration bonds. This means that if interest rates rise, the prices of long-term bonds will generally fall more than the prices of short-term bonds.

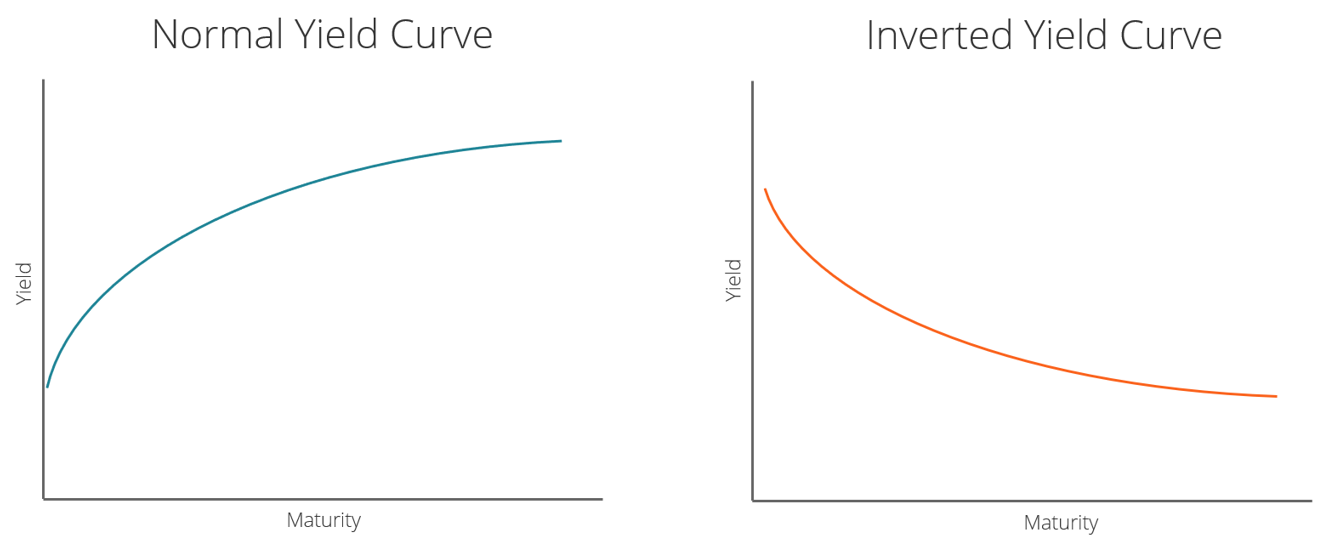

- Yield Curve: The relationship between bond maturities and their yields is represented by the yield curve. A yield curve is a line that plots yields, or interest rates, of bonds that have equal credit quality but differing maturity dates. The slope of the yield curve can predict future interest rate changes and economic activity.

- A normal yield curve slopes upward, with longer-term bonds having higher yields than shorter-term bonds. This curve indicates yields on longer-term bonds continue to rise, responding to periods of economic expansion.

- An inverted yield curve, on the other hand, has shorter-term yields higher than longer-term yields. Such a yield curve corresponds to periods of economic recession, where investors expect yields on longer-maturity bonds to trend lower in the future.

- Source: Corporate Finance Institute

- Credit Risk: In addition to interest rate risk, bond prices can also be influenced by credit risk. Bonds with higher credit risk (e.g., lower credit ratings) may see more significant price fluctuations due to changes in market sentiment and perceived creditworthiness.

Investors and bond traders closely monitor interest rate movements and their potential impact on bond prices to make informed investment decisions and manage risk in their bond portfolios. Let us see from illustration below :

In Malaysia, as in many other countries, the relationship between bond prices and interest rates is inversely proportional. This means that when interest rates rise, bond prices fall, and when interest rates fall, bond prices rise. The rationale behind this inverse relationship lies in the opportunity cost of investing in bonds.

Let's illustrate this concept with an example: Imagine you purchased a Malaysian government bond with a fixed coupon rate of 4% when the prevailing market interest rate is also 4%. In this scenario, your bond is competitive with other investments offering the same return. However, if market interest rates were to rise to 5%, new bonds issued at this higher rate would be more appealing to investors than your existing 4% bond. Consequently, the value of your bond would decrease in the secondary market to align with the current interest rate environment.

The Role of the Malaysian Central Bank

In Malaysia, the central bank, known as Bank Negara Malaysia (BNM), plays a pivotal role in influencing interest rates. BNM utilizes monetary policy tools to manage inflation, stabilize the currency, and foster economic growth. One of the primary instruments BNM employs is the Overnight Policy Rate (OPR), which sets the benchmark interest rate for the Malaysian financial system.

Changes in the OPR have a direct impact on interest rates throughout the Malaysian economy, including those on bonds. When BNM raises the OPR to combat inflation, bond yields tend to rise, leading to lower bond prices. Conversely, when BNM lowers the OPR to stimulate economic activity, bond yields often decrease, resulting in higher bond prices.

Impact on Investors

The relationship between bonds and interest rates in Malaysia has significant implications for investors. Bond investors must carefully assess interest rate trends and the central bank's monetary policy decisions to make informed investment choices. In a rising interest rate environment, investors may favour shorter-term bonds to mitigate the risk of capital losses, as shorter-term bonds are less sensitive to interest rate changes. Conversely, in a declining interest rate environment, longer-term bonds may become more attractive due to their potentially higher yields.

Conclusion

The intricate relationship between bonds and interest rates in Malaysia underscores the importance of staying informed and adaptable in the ever-evolving world of finance. Investors, both domestic and international, must closely monitor the central bank's policies and the prevailing interest rate environment to make sound investment decisions. By understanding this unique interplay, individuals and institutions can navigate the Malaysian bond market with greater confidence, mitigating risks and seizing opportunities as they arise.

Disclaimer

This report has been prepared and issued by Bond and Sukuk Information Platform Sdn Bhd (“the Company”). The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalized financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, the Company does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 05, 2026

|

5 min read

ARTICLE

Feb 04, 2026

|

4 min read

ARTICLE

Jan 30, 2026

|

6 min read

ARTICLE

Dec 22, 2025

|

6 min read