BIX ARTICLE

Features of Bond and Sukuk That You Need to Know

Oct 03, 2019

|

9 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

As you go through this article and read each feature of the bond, you can use BIX Malaysia to find the information of a particular bond by using BIX SEARCH. You can learn how to find the information by watching this tutorial video Navigating to BIX or find related articles in our article section.

1. The Bond's Issuer

Bonds are issued by issuers to finance a specific need such as to meet the capital budget, working capital and also for funding a special project. As a bond investor, you need to know the background of the bond issuer and the nature of its business such as construction business, manufacturing business and others. By learning the nature of the business, you can assess the risks and the potential revenue the company/the issuer can make from its business, hence, giving you a grasp where the issuer’s financial health standing is. An issuer with a strong financial standing is less likely to default on the bond.

There are three types of bond issuers:

- Governments

- Government issues bonds to fund for its administration and public projects and the government bonds are considered as the safest bond. Malaysian Government Securities (MGS) and Government Investment Issue (GII) are examples of Malaysian government bonds. The ratings of Government bonds are typically very high; however, it depends on the economic condition of the countries. Government's bond issued by developing countries is riskier than the one issued by developed countries.

- Special Projects

- Corporates or government may come up with a project that requires fund, and the bond will be matured once the project is completed. These bonds are tied up to a specific project, such as infrastructures, and some of these bonds are guaranteed by the government. A few examples of special projects in Malaysia funded by bonds are Kuala Lumpur International Airport 2 and My Rapid Transit (MRT) project, which were funded through sukuk and bond issued by Dana Infra Nasional Bhd respectively.

- Corporates

- The most common bonds are issued by corporates. Corporates issue bond when they need funds to finance a project or for working capital. In Malaysia, bonds issued by corporates will be rated by rating agencies, such as RAM and MARC. Even though the corporates already be rated by the rating agency, the bond that they issued could differ from the rating the corporates have. For instance, a company with a rating of AAA may issue a bond of AA rating.

All information about the issuer and how the funding would be used can be found on the Principal Terms and Condition Document, which will be discussed later in this article.

- The most common bonds are issued by corporates. Corporates issue bond when they need funds to finance a project or for working capital. In Malaysia, bonds issued by corporates will be rated by rating agencies, such as RAM and MARC. Even though the corporates already be rated by the rating agency, the bond that they issued could differ from the rating the corporates have. For instance, a company with a rating of AAA may issue a bond of AA rating.

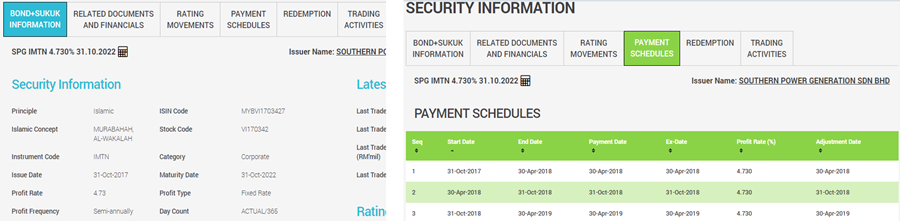

2. Bond’s Maturity and Payment Schedule

Bond maturity is the remaining life of the bond. While payment schedule tells investors the historical date and the future date of the coupon payment throughout the bond’s life. Bond maturity can be grouped into short term, intermediate-term, long term and perpetual.

Each bond with different maturities carries a different degree of risks and coupon rate. For instance, bonds with longer maturity have a higher interest or coupon rate to compensate for high risks of the long-term bond. A long-term bond is more volatile than the short-term one. As the tenure of the bond is longer, there would be many economic events that will take place, which can affect the value of bonds.

Therefore, before investing in a bond, it is advisable for you to determine how much risks can you take for your investment. If you are a risk-averse investor, you may want to invest in a short-term bond. However, if you are a risk-taker investor, you may want to invest in a long-term bond.

You can find the information on maturity and payment schedule of the bond at BIX Malaysia by typing in the stock code of the bond in the comprehensive search function on BIX Malaysia homepage. Alternatively, you can also type in the issuer’s name of the bond into BIX Issuer Search. The maturity information will be on the security information page , and the payment schedule information will be on the payment schedules tab, as shown below

3. Bond Covenant

A bond covenant is a legally binding term of the agreement between the bond issuer and the bondholders or investors. There are three types of bond covenants - positive covenants, negative covenants and financial covenants (Read the description of each type of covenants here). The main function of the covenant is to protect the interest of both bondholders and the issuer. Investors can read the terms of the bond covenant in the Principal Terms and Conditions (PTC) document.

It is crucial for investors to go through the PTC document so that investors are aware of the things that issuer is allowed and not allowed to do throughout the bond’s tenure. A breach of the covenant may impact the credibility of the issuer and lose trust with investors. In some cases, it may also affect the cash flow of the issuer as to what happened to the Bright Focus Bhd in past months who got downgraded for breaching the covenant which you can read further the issue in the article “Bright Focus Bhd downgraded to BB1 on Covenant Breach”.

Besides PTC documents, there are other related documents as important as PTC that investors need to go through too, such as Information Memorandum and Trust Deed document. Information Memorandum discusses in more details about the business nature of the issuer, while Trust Deed is the agreement between the borrower to transfer legal title to real property to an impartial third party, a trustee, for the benefit of a lender, as security for the borrower’s debt.

4. Ratings

Corporate bonds can be rated by the credit rating agencies like RAM and MARC to testify the issuers’ abilities to pay the coupon semi-annually and return the principal to investors at maturity. Corporate issuers also can choose not to rate their bonds, but in this case, they need to pay a higher coupon payment to investors to compensate for the uncertainty of risks of the unrated bonds.

Government bonds such as MGS and GII are safer than corporate bonds, thus, they are not rated as the coupon payment and principal are guaranteed by the government.

Credit rating agencies will rate the bond based on issuers’ probability of default and their capabilities to pay the expected payment to investors based on this rating tier;

Bonds with a rating above A is considered safe investments with a low probability of default and the issuers have a strong financial capacity to return the principal at maturity. You can read more about credit rating and rating agency.

5. Bond Coupon and Yield

Bond coupon is the interest rate that the bond issuer pays every semi-annually or annually. A bond coupon rate is a percentage of its par value, which is the value of the bond at the time it was issued. For example, a RM1,000 bond that has a 4% coupon rate will pay RM40 of interest every year.

At first issuance, the yield of the bond will be equal to its coupon rate. However, once the bond is placed in the secondary market, the price will fluctuate, and so does the yield. Current yield is commonly used to measure the rate of return of bonds given its market price. For example, a RM 1,000 bond with a 6% coupon rate and a premium price of RM 1100 will have a 5% (RM 60/RM 1,000) current yield. On the other hand, the same bond sold at a discount price of RM 800 will have a 7.5% (RM 80/ RM 1,000) current yield. Thus, the lower the purchase price of bonds in the secondary market, the higher the current yield or return.

As an investor, it is important to know the yield to maturity upon purchase as that is the respective return or yield you will earn throughout the bond holding period regardless of the original bond’s coupon.

6. Sukuk Contract

Bonds also have its Islamic counterpart, which is called sukuk. Sukuk has various types of contracts that vary from one transaction to another (Read different types of Sukuk contracts in Malaysia here). All sukuk contracts have a different structure that is approved by the Sharia body. Therefore, it is important for you to understand the risk associated with the said sukuk contract before investing.

When you search for a specific bond on BIX Malaysia, we provide the information on whether the bond is conventional or Islamic (sukuk) on the security information page. Alternatively, you can also read the PTC document of the bond. If the bond is Islamic, the type of contracts and how the transaction is conducted under the contract is explained in detail in the PTC document.

Conclusion

These features of the bond are important for you to know before deciding to invest your money in the bond market. You need to know the issuer, maturity, covenants, rating, price and yield of the bond to make sure the bond meets your criteria and your investment goals.

You can use the BIX Malaysia website to find all the information that you need about the bond that you are interested to invest in. Watch the video down below to learn how to find the information at BIX Malaysia.

Disclaimer

This report has been prepared and issued by Bond and Sukuk Information Platform Sdn Bhd (“the Company”). The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, the Company does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Dec 01, 2025

|

4 min read

ARTICLE

Nov 04, 2025

|

4 min read

ARTICLE

Oct 16, 2025

|

5 min read

ARTICLE

Sep 03, 2025

|

4 min read