BIX ARTICLE

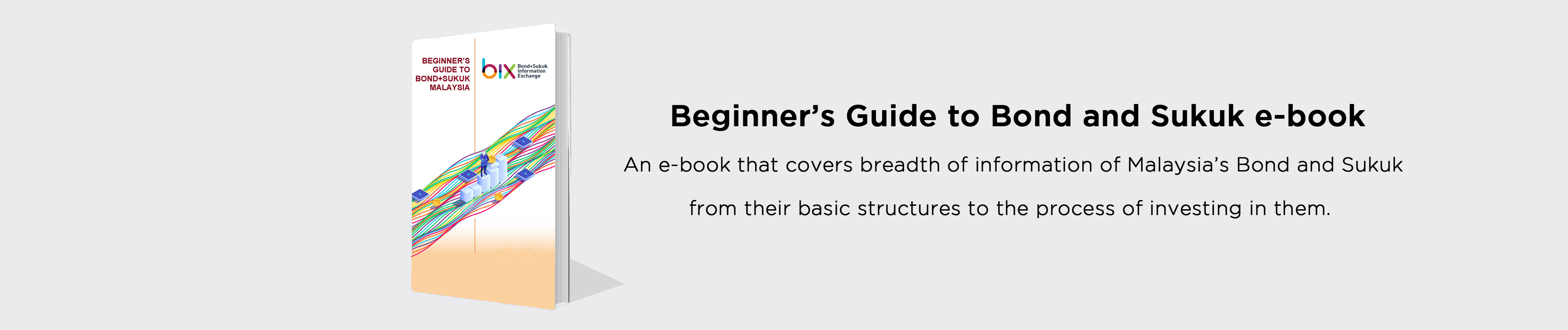

Beginner’s Guide to Bond and Sukuk Malaysia (Free e-book)

Feb 14, 2020

|

3 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

.png?width=900&height=189)

Bond and sukuk are financial instruments that are somehow still less known and strange among the general public. Like any other financial instruments such as stocks, bonds and sukuk provide an investment opportunity for people to earn returns and additional income. The different thing about bond and sukuk is, they generate a periodic fixed income to investors, and the principal will be returned at maturity (except in the event of default). It is a loss of opportunity in not getting to learn these types of financial instruments as bonds and sukuk can be a good investment option to increase wealth.

(Read: Bond Characteristics Article)

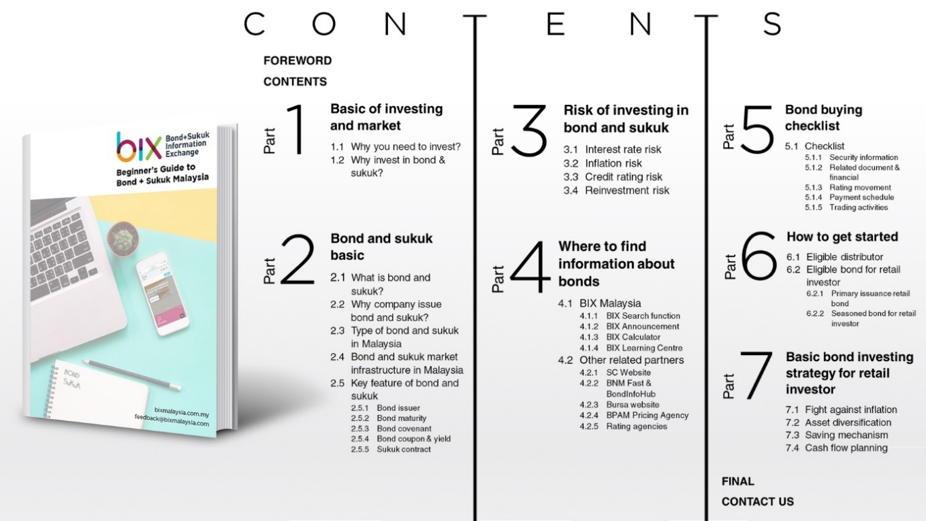

Beginner’s Guide to Bond and Sukuk Malaysia e-book has a breadth of information about the bond and sukuk market in Malaysia, from their basic structures to the information on how to invest in these financial instruments in the Malaysian market. This e-book is suitable for the general public who wants to learn about investing in Malaysia’s bond and sukuk, entry-level professionals, students, and academicians who are looking for resources for their research.

The Beginner’s Guide to Bond and Sukuk Malaysia is available for free via BIX Mobile App, and it is compatible with both desktop and mobile.

.png?width=200&height=200) |

.png?width=200&height=200) |

In this e-book, readers will get to know some of the risks associated with investing in bonds and sukuk and understand how each risk can impact their bond and sukuk investments. Risk is inevitable in any investments, including bonds and sukuk. Still, it is an essential factor in determining the potential return of an investment. Learning about risks associated with the investment can help to manage risk-reward expectations on the investment, and to navigate investment strategy.

The Beginner’s Guide to Bond and Sukuk e-book also provides a checklist on what information regarding an individual bond or sukuk that prospective investors need to assess, before deciding to invest in that bond or sukuk. For example, one of the things that prospective investors need to assess is the bond’s rating. Some corporate bonds are rated with different levels of ratings to reflect their credit qualities and the probability of defaults. If the rating is downgraded, the probability of the bond to default is higher. The Beginner’s Guide to Bond and Sukuk will also show readers where they can get the rating information of the individual bond or sukuk.

If you are interested to learn more about the bond and sukuk market in Malaysia and how to invest in these financial instruments, you can get this free e-book via BIX mobile app.

Download the preview: E-book_Preview.pdf

|

|

Download the full version:

Get Beginner’s Guide to Investing in Bond and Sukuk Malaysia via Google Play

Get Beginner’s Guide to Investing in Bond and Sukuk Malaysia via Apple Store

YOU MAY ALSO LIKE

ARTICLE

Feb 14, 2020

|

3 min read

ARTICLE

Jan 08, 2019

|

6 min read

ARTICLE

Jul 02, 2018

|

6 min read

ARTICLE

May 16, 2018

|

4 min read